1. Introduction

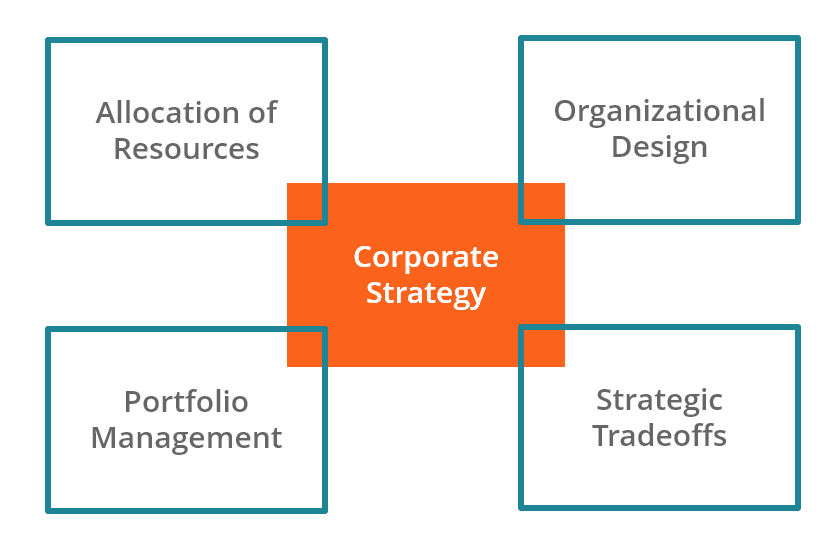

In this era of globalization, almost all the organizations in the world are facing dynamic challenges. The organizations are required to think strategically with the use of effective corporate strategies to be competitive in the world’s market (Lamb, Butler, & Roundy, 2017). Corporate strategy refers to decisions and commitments of the organizations towards the achievement of strategic competitiveness. This report is a detailed analyses of corporate level strategies adopted by KPMG which is a multinational professional services network, and one of the big four accounting organizations, along with Deloitte, Ernst &. . .